[insert_php] $id = $_GET[“id”]; [/insert_php]

Bondora Go And Grow P2P DEMO

Bondora Go And Grow P2P REVIEW

Bondora Go And Grow P2P Preview: (to pause video, simply tap/click on it)

Summary

Bondora Go And Grow P2P is an established and reputable P2P lending platform

Read 100% Free Bondora Go And Grow P2P Review by Scamorno Team

Details

| Platform | Bondora Go And Grow P2P |

|---|---|

| Website URL | www.Bondora.com/GoAndGrowP2P |

| Trial | Start Trial |

| Overall Score | 9.4/10 |

FULL REVIEW OF Bondora Go And Grow P2P

Are you looking for more information about the Bondora Go And Grow P2P platform and is it really one of the best alternative investment platforms that offers high lending liquidity opportunities with good returns? Founded in 2008, Bondora has established itself as one of the most venerable and reliable peer-to-peer platforms in the market. Historically, investors seeking to allocate their funds with Bondora were limited to the option of directly investing in consumer loans through Portfolio Pro or their Portfolio Manager.

However, a pivotal moment in Bondora’s evolution occurred in May 2018 with the introduction of Go and Grow P2P. This innovative offering presents a significant advantage over other crowdlending platforms by affording investors the unprecedented flexibility to access their funds whenever necessary – a feature notably absent in alternative lending platforms, notwithstanding the potential to trade loans on secondary markets. Bondora Go And Grow P2P seamlessly allocates invested capital into a meticulously diversified portfolio encompassing tens of thousands of loans spanning various credit ratings, ranging from AA to HR.

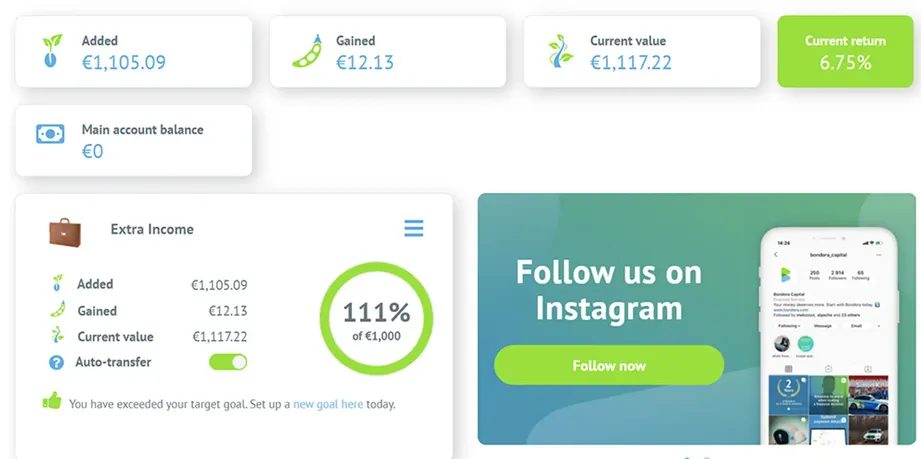

It is worth noting, though, that the convenience of immediate liquidity does come at a modest trade-off. The annual interest rate, while competitive, hovers at approximately 6.75%. This represents a considerably higher return compared to what one can typically attain through various other investment avenues available today, where accessibility to invested funds is often restricted for several years.

Review Verdict: Bondora Go And Grow P2P is a legitimate P2P lending platform

Visit Bondora Go And Grow P2P Website

Who Are The Owners Of Bondora Go And Grow P2P?

The precise structure remains undisclosed. However, it is reasonable to infer that the majority of shares are likely held by the founders, namely Pärtel Tomberg, Mihkel Tasa, and Martin Rask. Additional ownership stakes may be attributed to members of the Supervisory Board, including Joao Monteiro, Mati Otsmaa, and Phil Austern, as well as financial entities such as Valinor Management LLC from the United States and Global Founders Capital GmbH Co from Germany.

Bondora Go And Grow P2P Funds Deposit Process:

Depositing funds into a Bondora account involves a straightforward process that can be summarized in three steps:

- Initiate a transfer of funds from your personal bank account to your Bondora Go And Grow P2P account using various options such as bank transfer, Transferwise, Revolut, VISA or Mastercard payment, or SOFORT Online Payment.

- Typically, the transferred funds become available for investment within 1 to 3 banking days.

- Following the successful deposit of funds into your account, Bondora Go And Grow P2P will promptly notify you via email.

For those looking to withdraw funds from their Bondora Go And Grow P2P account, the process is equally uncomplicated. Simply click on the “withdraw funds” option, specify the desired withdrawal amount, and anticipate the funds to be disbursed within 1 to 3 business days. Notably, there are no minimum withdrawal restrictions, and Bondora does not impose any additional fees or commissions for fund withdrawals, although your personal bank may have its own fee structure.

How Is Bondora Go And Grow P2P Different From Other P2P Lending Platforms?

In contrast to various other platforms, Bondora Go And Grow P2P does not offer a buyback guarantee for its loans. This characteristic need not pose a concern, provided one adopts a prudent investment strategy. A recurring observation among Bondora users over recent years has been dissatisfaction due to suboptimal returns or even financial losses incurred on the platform. However, a closer examination of their investment portfolios revealed a common trend – many had chosen to invest in high-yield, albeit high-risk loans on the platform. Unfortunately, a significant portion of these loans defaulted, resulting in unfavorable outcomes for these individuals.

In light of these findings, a conservative approach to Bondora is strongly recommended. For those seeking peace of mind, the suggestion is to consider Go & Grow, which offers a hassle-free experience. Alternatively, the portfolio manager with the most conservative settings can be a suitable choice. Investors with a more advanced level of experience may opt for portfolio pro, but it is advised to limit investments to the safest loans on the platform, typically those rated A or B.

Furthermore, as a general practice applicable to all platforms, diversification is key. Maximizing diversification by investing in a wide array of loans can substantially mitigate the risk associated with your investment portfolio.

How Safe Is Investing In The Bondora Go And Grow P2P Platform?

For a substantial duration, critics aimed at P2P platforms often lamented the absence of a true market crash. This narrative underwent a significant transformation in March 2020 when a substantial market downturn happened. While the United States witnessed the initial tremors of real estate funds faltering, akin to the 2008 crisis, Bondora Go And Grow P2P remained resilient and unaffected.

Within the world of P2P platforms, a discerning eye towards established, reputable entities is extremely important. As with any sector where financial gain is pursued, P2P platforms have not been immune to the presence of unscrupulous actors. However, Bondora Go And Grow P2P, having operated since 2009, stands apart from such dubious entities. With over 200 million Euros disbursed in loans and an average yield of 10.5% distributed to investors, it has cultivated a history of trustworthiness and stability.

Despite these commendable achievements, it’s essential to acknowledge that P2P loans inherently carry a degree of risk. Consequently, it is advisable to allocate only a modest portion of one’s financial portfolio to such investments. The age-old wisdom of not placing all one’s assets in a single investment applies here as well.

Within the purview of the Schwiizerfranke portfolio at Bondora Go And Grow P2P, no reports of delays or reduced returns have emerged in response to the financial turbulence of 2020. Likewise, no concerns have been voiced by the readership. Nonetheless, there are indications that a segment of investors who committed substantial sums may have grown wary. Their presumption, it seems, was that a financial crash was an improbable event, leading them to seek to liquidate their loans and withdraw funds simultaneously. It’s important to remember that P2P platforms must always locate buyers for sellers, akin to a stock exchange. Consequently, delays in payment appear to have surfaced among these hasty withdrawals. The Schwiizerfranke portfolio has chosen to maintain its investments and monitor the unfolding situation. For those with an appetite for risk, it’s noteworthy that bargain hunters can presently acquire loans at favorable rates on Bondora Go And Grow P2P’s secondary market, akin to stock market dynamics.

Bondora, commendably, has prepared for such crises. Within the Bondora Go And Grow P2P framework, investors are provided with a fixed return of 6.75% on their invested capital. The mechanism at play mirrors the characteristics of an overnight deposit account with an interest rate of 6.75%. Behind the scenes, Bondora Go And Grow P2P efficiently deploys invested capital to generate returns exceeding the 6.75% threshold. Anything exceeding this rate is construed as profit, serving as a safeguard for unforeseen events such as the Covid Crash.

Review Verdict: Bondora Go And Grow P2P is a legitimate P2P lending platform

Visit Bondora Go And Grow P2P Website

Consumer Alert Regarding Bondora Go And Grow P2P

The success of Bondora Go And Grow P2P has given rise to many frauds who try to sell their own fake platforms in its name. This is a big issue as many customers have lost their money in joining from such fake sites. It is advised that customers should be really careful when they are subscribing and should do some research before they join any website. To spot these, watch out and avoid sites that claim to write about Bondora Go And Grow P2P, yet the writeup is completely garbage as they are created by software and spammed all over the internet. It is always better to avoid buying from any other website other than the official one. Therefore, it is highly advised that consumers do careful research, or only buy join the site from the official website here – http://Bondora.com/GoAndGrowP2POfficial (link opens in a new window). The official website that they have includes the legitimate platform.

Conclusion about Bondora Go And Grow P2P

In summary, we have found Bondora Go and Grow P2P to stand out within its niche, introducing valuable attributes not readily available on other P2P investment platforms. Notably, it provides swift liquidity and the option for deferred tax payments. Those who have a keen interest in liquidity and tax deferral will certainly find this platform to be an enticing proposition. Hence, if you too would like to start automating your investments with a P2P lending platform of a strong track record, low investment minimum and competitive yields, then we highly recommend you to learn more about the Bondora Go And Grow P2P platform at the button link below!